Partner content

Self employed or small firm owner? Your 2021 tax return questions answered

You’ve probably already had more than one blue tax office envelope drop through your door this year. And that can only mean one thing… it is nearly tax return time. Orange Tax expert Arnold Waal has been helping the self employed and small firm owners deal with their tax affairs for more than a decade. Here are the most common questions he gets asked at this time of year.

What is the deadline for a small firm to submit their tax return?

For corporate tax returns, the deadline is June 1, and for personal income tax itself, May 1. But if you are hoping to get a refund because you paid too much tax, and would like to get that before the summer (July 1), you should apply by April 1.

If you want to delay it, what should you do?

Easy. Just ask before the official deadline has been. You should be able to get a delay until September without difficulty. If you want a longer delay, get in touch with your tax advisor before April 1 and they can ask for you.

So don’t wait until you get the first reminders from the tax office, and don’t forget to file if you have been granted an extension.

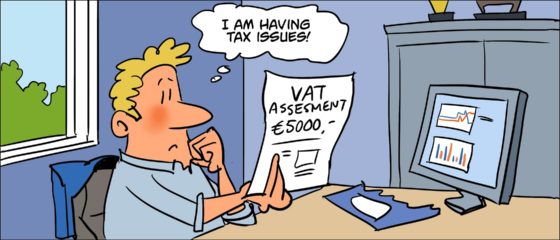

The tax office has just sent me a €5,000 fine. Why?

See it as a gentle reminder to get your book keeping sorted. The penalty was triggered by failing to file your value added tax (btw) return. The moment you start a company and have a btw number, you are required to file a return every quarter – whether or not you actually made any money.

The €5,000 is a way of encouraging you to file. Once you do so, the penalty will probably be dropped. If you ignore it, the penalty will go up every quarter. So either fill in the online form every three months or ask your tax advisor to do it for you. But don’t just sit there, collecting blue envelopes.

If I have a BV, do I have to send a financial report to the Chamber of Commerce?

If I have a BV, do I have to send a financial report to the Chamber of Commerce?

Yes you do, and you should publish this before the next calendar year ends. If you don’t comply, the management can be held personally liable in case of bankruptcy or liquidation.

Okay, I really can’t face doing it myself. How much does it cost to get specialist help with filing a tax return?

Orange Tax currently charges €390 plus btw for a personal tax return although this will go up to €410 in July. That price includes answering questions and appealing a tax office decision if it is not in line with expectations.

You can also contact Orange Tax if you need to file a tax return in the US, or have questions about the 30% ruling expiring.

An income tax return for small business owners costs €550 ex btw.

My problems might be more complicated. What then?

Talk to a la carte corporate tax expert and expect to pay an hourly rate.

By the way, if you have been in the Netherlands for some time, and become pretty Dutch, you might like to know that you can only declare business lunches, if you state on the back of the receipt who you ate with. Lunch with yourself, family or during a normal work day are not declarable.

And as for a company bike… you will have to add 7% of the recommended retail price of a new bike to your taxable income because, believe it or not, it is considered a perk.

Thank you for donating to DutchNews.nl.

We could not provide the Dutch News service, and keep it free of charge, without the generous support of our readers. Your donations allow us to report on issues you tell us matter, and provide you with a summary of the most important Dutch news each day.

Make a donation