Investigate house valuations, reduce loans, log bids better: AFM

Senay Boztas

At a time of geopolitical uncertainty that threatens Dutch financial stability, the Netherlands Authority for the Financial Markets (AFM) has called for an investigation into professionals involved in the Dutch housing market.

In its annual report, the AFM warned of the risks of global volatility but noted that Dutch house prices have, despite this, continued to rise. It has recommended an investigation into the “quality of valuations”, warning about the behaviour of lenders, advisers and property valuers and the need for more consumer protection.

“Policy and the behaviour of credit lenders, advisors and property valuers need to prevent the housing market from overheating,” it said. “To get more insight into the quality of house valuations, it would be good to do further investigation…It is also beneficial for buyers if the bidding process is transparent. A bid log book that provides buyers with insight into the bids made would contribute to this.”

Highest borrowing

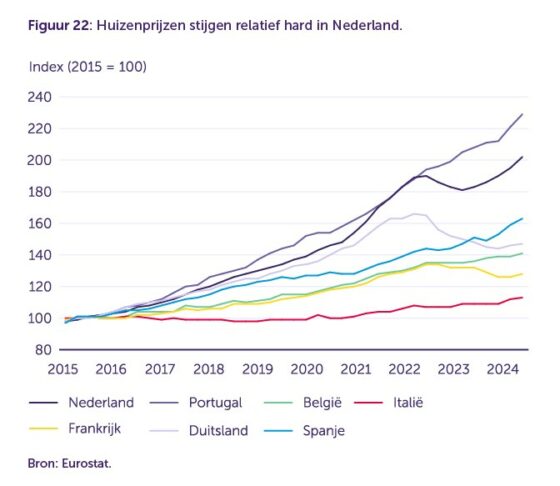

Although there was a slump in 2023, Dutch house prices rose by an average of 10.6% in the past year. In comparison to other European countries, property prices have only risen more in Portugal, the AFM notes – and the amount borrowed to fund Dutch homes has never been higher.

While mortgage debt has fallen slightly in comparison to the country’s gross domestic product – which includes the proceeds of letterbox companies – Dutch household debt as a proportion of GDP is still the highest in Europe.

The AFM warns that higher mortgage debts can make more households financially vulnerable, for example in the case of a separation or job loss. “Households often give the most priority to paying their rent and mortgage costs,” said the AFM in its annual report. “With financial problems, their missing payments will first start to rise on other accounts.”

Survey

In the Netherlands, mortgage lenders offer credit on the basis of a house valuation or “taxatie”, rather than a building survey by a chartered surveyor. House valuations can be done remotely.

The AFM has pointed out that if people are making offers on houses that are not subject to a professional building survey, this risks missing severe flooding and rainfall risks and the foundations problems in half a million Dutch houses that homeowner association Vereniging Eigen Huis has called a “ticking time bomb”.

“Climate risks must be taken into account when valuing houses,” says the AFM report. “In the current housing market, it has become normal to place bids without a financing clause or structural survey in order to increase the chances of a winning offer. A disadvantage of this is that structural risks may not be adequately considered in bids, and households may end up paying too much.

“For example, the risk of foundation damage may not be properly reflected in the price. Research has shown that the likelihood of this risk materialising will increase in the coming years. Consumers are often unaware of this risk.”

Gap

A recent report by AMN AMRO showed that the Netherlands is one of the countries where people can borrow the most against a house – and the gap between house prices and income has increased by 31.6% since 2014, the second highest gap in Europe.

Housing experts, the DNB central bank, the European Commission and the Dutch government report that Dutch tax breaks for homeowners pump prices beyond their natural level.

The AFM said that although the market may be turning, houses are ever less affordable and particularly for first-time buyers. From 2023, the Dutch government increased the possibility to borrow by accounting for a second income fully, but the AFM suggested the government should act to reduce lending, rather than promoting it. “Targeted fiscal policy can help to temper lending behaviour, and therefore the price of houses, instead of stimulating them,” said the AFM.

On Tuesday, the DNB central bank and Central Planbureau agency warned that the geopolitical risks to Dutch economic stability have never been greater. The DNB says Dutch houses are overvalued according to European Systematic Risk Board analysis, and a price correction is one of the country’s main financial risks.

Thank you for donating to DutchNews.nl.

We could not provide the Dutch News service, and keep it free of charge, without the generous support of our readers. Your donations allow us to report on issues you tell us matter, and provide you with a summary of the most important Dutch news each day.

Make a donation