‘Madness’ over: house prices drop almost 6% in three months

The average house sold for 5.8% less in the last financial quarter than between April and June, according to figures from estate agent association NVM.

Its agents’ third quarter results are the first solid indication that the Dutch property market is taking a downturn, after months of fierce growth. Figures from the CBS Dutch statistics office, which measures all sales on completion, indicated a 0.1% price drop from July to August.

The quarterly drop in prices registered by the NVM is the steepest it has ever measured in such a short period.

At the end of 2021 the NVM, which monitors homes sold by its accredited agents, said house prices were growing year-on-year by 21.5%. That year-on-year growth has now plummeted to 2%.

Stock up

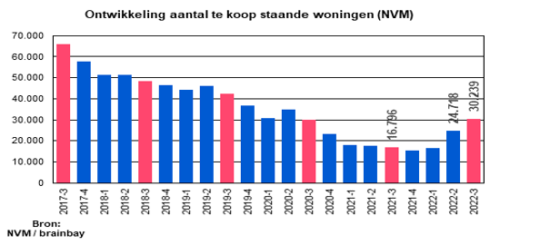

Eighty per cent more homes are on the market with NVM estate agents now than a year ago, with the stock growing from 16,796 properties to 30,239. Roughly the same number of homes sold in the third quarter of 2022 as a year before, some 32,500, and the average price was €425,000.

However, compared to historic levels, there are still relatively few houses on the market, while the Netherlands has a shortage of housing in general – including social housing and homes for private rent.

In some areas, NVM agent prices have however fallen year-on-year, including in IJmond and around Haarlem. In the past three months, house prices have fallen by around 8.5% in these two areas; there have also been marked price drops in greater Amsterdam (-7.6%), around The Hague (-6.9%) and in Utrecht (-6.4%).

Prices per square metre in the third quarter varied from an average of €2,315 in East Groningen to €6,399 in greater Amsterdam. The average price per square metre across the country dropped 5% from the second financial quarter this year.

Madness

The NVM said the housing market was returning to normality, with the quadrupling of mortgage interest rates to more conventional levels of 4%-plus. Lana Gerssen, deputy chair of the NVM, said in a statement: ‘The figures for the third quarter of 2022 indicate that the extremely overheated market of the last one-and-a-half years has reached a turning point.

‘The quarter-on-quarter drop in prices that we have measured is relatively modest, compared to the extreme rises of recent quarters. However, we are still far from a normal market as the supply both in terms of numbers and types of houses is insufficient. The influence of increased mortgage interest rates, sky-high energy costs and inflation is taking the madness out of the market.’

She added: ‘Although supply on the housing market is growing, so is the number of households and demand for housing…with a current shortage of more than 300,000 homes.’

Figures provided by the NVM to Dutch News show that the number of homes for sale with its member agents has varied wildly over the past 10 years, from about 180,000 a decade ago, to a low of around 15,500 at the end of 2021: the average is around 84,000.

Young

Segments of the current market are, however, seeing better levels of interest. Some mortgage lenders have reported an increase in people up to the age of 35 taking on a mortgage in the third financial quarter this year.

De Hypotheker broker suggested they could be taking advantage of a stamp duty holiday and the possibility for parents to gift them €106,671 free of tax for a home this year only.

CBS figures for all houses sold in September will be available in late October.

Thank you for donating to DutchNews.nl.

We could not provide the Dutch News service, and keep it free of charge, without the generous support of our readers. Your donations allow us to report on issues you tell us matter, and provide you with a summary of the most important Dutch news each day.

Make a donation