Hema may change hands again: investors will swap debt for shares

Hedge funds and other investors who have put money into Dutch high street staple Hema are trying to take over ownership of the company in return for cancelling €300m worth of debt, the Financieele Dagblad and NRC said on Thursday.

The investors have approached billionaire Marcel Boekhoorn, who took over the company in 2018, about the deal, the papers say.

Combined they have debts of some €600m in Hema and are concerned that they may never be repaid because the company currently has outstanding debts of €800m. In order to recover what they can, the investors are prepared to swap debt for shares, the papers said.

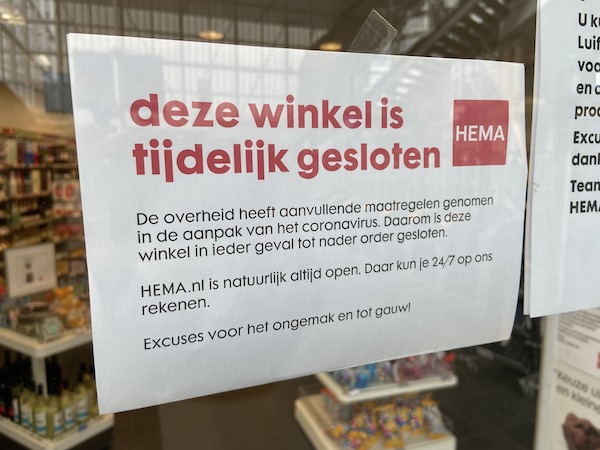

A dramatic 30% fall in sales caused by the coronavirus crisis has already prompted CEO Tjeerd Jegen to tell landlords and staff – but not shareholders – to make financial sacrifices, the Financieele Dagblad reported earlier.

A letter outlining the measures said that ‘as a consequence of the closure of the shops in the countries around us and the continuing loss of revenue in the Netherlands, the survival of the company will shortly be in doubt.’

Hema, bought by Marcel Boekhoorn only 18 months ago, has been loss making since 2013.

The company is also looking to the government’s emergency fund which compensates up to 90% of wages. Hema employs 11,000 people of whom 9,000 work in the Netherlands.

Thank you for donating to DutchNews.nl.

We could not provide the Dutch News service, and keep it free of charge, without the generous support of our readers. Your donations allow us to report on issues you tell us matter, and provide you with a summary of the most important Dutch news each day.

Make a donation